Bitcoin Mining Pools Explained: Types, Payouts, and Top Players

Bitcoin mining in 2025 is a high-stakes game. The days of solo miners winning Bitcoin with laptops are long gone. Today, Bitcoin’s difficulty is at record highs , ASIC hardware is more efficient than ever, and global mining competition is fierce.

To stand a chance of earning block rewards, most miners now work together by combining their hash power through mining pools. Think of it as crowdsourcing computational power. Instead of one machine racing for a reward, thousands of machines share the work and split the prize.

What Is a Mining Pool?

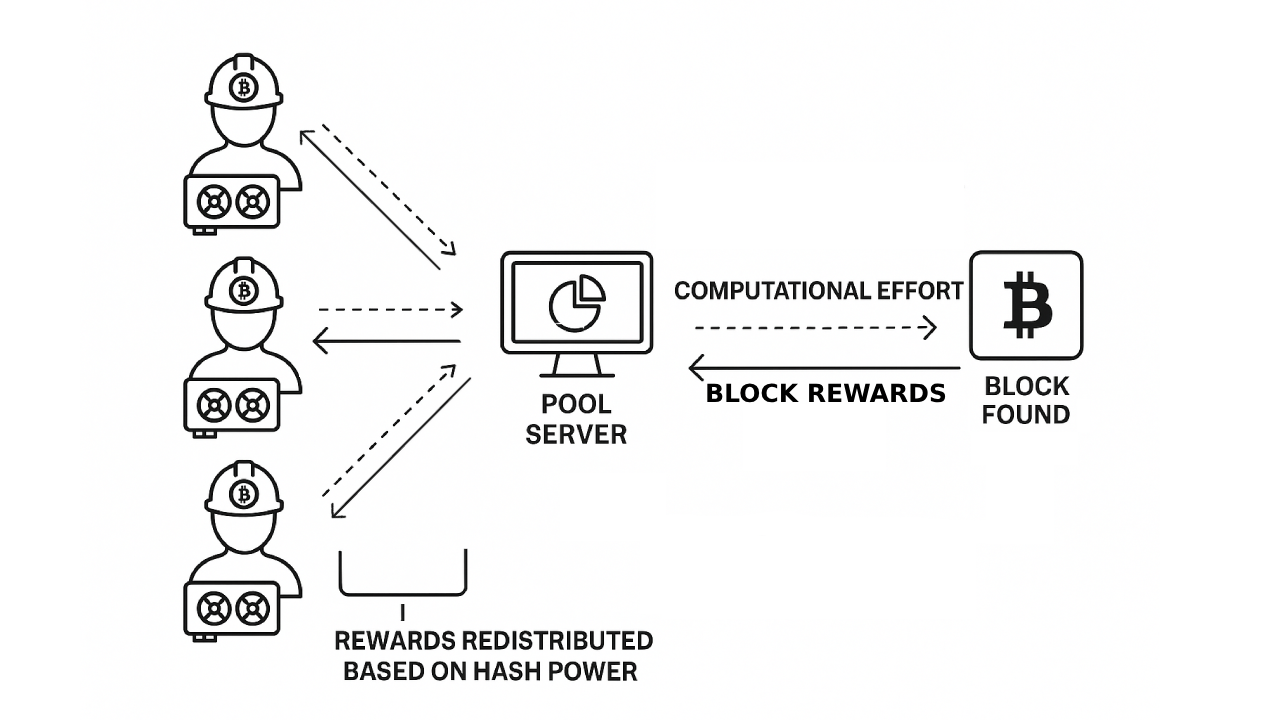

A mining pool is a group of Bitcoin miners who work together to increase

their chances of earning rewards. Mining pools are typically run by pool

operators who provide the server infrastructure, software, and payout

logic. Instead of competing alone, miners in a pool combine their

computational resources. This combined computational power or hash

power is used by the pool in trying to solve Bitcoin’s next block. When the

pool succeeds, rewards are distributed proportionally based on each

miner’s contribution.

The concept of pooled mining was introduced in response to the growing

difficulty of solo mining, which made it increasingly hard for individual

miners to earn consistent rewards. In November 2010, Czech developer

Marek “Slush” Palatinus launched the world’s first Bitcoin mining pool,

originally known as Bitcoin.cz and later renamed Slush Pool. By allowing

miners to contribute smaller shares of work toward a collective effort, the

pool helped reduce reward variance and made earnings more

predictable. This innovation marked a turning point in Bitcoin’s

infrastructure, offering a more accessible entry point for smaller miners

without industrial-scale hardware.

In 2022, Slush Pool rebranded to Braiins Pool under its parent company,

Braiins Systems, consolidating its mining operations and branding under

one name. Despite the name change, it remains the oldest active mining

pool in Bitcoin’s history.

How Mining Pools Actually Work

A lot of miners these days don’t individually compete to solve full blocks

anymore. Instead, they submit ‘shares’ or proofs-of-partial-work to the

pool. These shares can be considered as sub-units of the Bitcoin Proof-of-Work (PoW) mechanism.

The pool server tracks all these shares from participating miners. When

one of them successfully solves a block that meets Bitcoin’s difficulty

target, the pool submits it to the Bitcoin network on behalf of all miners

in the pool.

Then comes the reward distribution. Depending on the pool’s payout

model, the total block reward, and the transaction fees from that block

(in case of a few payout models) is split among contributors according to

how much work they proved through their shares.

Here’s a simplified flow:

- Miner connects to a pool via mining software.

- Miner submits valid shares to the pool server.

- Pool aggregates shares and monitors who contributes what.

- When a valid block is found, the pool broadcasts it.

- Then the pool distributes BTC rewards based on share contributions.

Types of Payout Models Used by Pools.

Once a block is found, we come to the next part - the reward distribution. Different pools use different payout models, and sometimes even offer the user the flexibility to choose a payout model as per their preference. Understanding these is crucial to managing your mining expectations and earnings. Let’s take a look at the the major ones:

| Payout Model | Description | Pros | Cons |

|---|---|---|---|

| PPS (Pay Per Share) | This model pays miners a fixed amount for every valid share submitted, irrespective of whether the pool does or doesn’t find a block. It is stable and predictable - like salary. |

- Predictable income, ideal for budgeted operations or consistent cash

flow needs - No need to wait for blocks to be found—you're paid for each share |

- Higher pool fees (often 4–6%) since the pool takes on more risk - Pool absorbs the variance, so rewards may be slightly lower over time |

| PPLNS (Pay Per Last N Shares) | This model pays only when a block is found, distributing rewards based on your contribution to the last ‘N’ shares, where N is the number of shares contributed by an individual miner. It is more like a commission model. |

- Lower fees, potentially higher earnings long-term - Encourages loyalty (best for long-term consistent miners) |

- Unpredictable payouts (may also be zero if pool doesn't find a block) - Not ideal for intermittent or small-scale miners |

| PPS+ (Pay Per Share Plus) | This model is a combination of PPS and PPLNS. The block reward is paid using PPS, while the transaction fees is paid using PPLNS. It is like a salary system with a bonus. |

- More stable income with extra upside during periods of high network activity - Suitable for miners with stable hash power who want risk-adjusted returns |

- Slightly more complex reward calculations - Still involves higher fees (3–5%) than PPLNS |

| FPPS (Full Pay Per Share) | This is a hybrid of PPS and transaction fee sharing. Miners get a fixed share for both the block reward and the average transaction fees in a block. |

- Fixed payouts + share of transaction fees - Balanced model: more upside than PPS and more stability than PPLNS |

- Slightly higher fees than PPLNS (2.5–3.5%) - Requires trust in accurate fee calculations by the pool |

Should You Join a Mining Pool?

You may think, why not just mine solo and keep all the Bitcoin for

yourself?

Because - unless you have a warehouse full of ASICs - your chances of

solving a block alone are kind of close to zero.

| PROS | CONS |

|---|---|

| More consistent and predictable payouts | Pool fees reduce total income |

| Lower technical and operational complexity | Centralization risk since a few pools dominate network hash power |

| Access to advanced features (e.g.,merged mining, pool analytics) | Trust issues with malicious pool operators or misconfigured payouts. |

| Lower variance in earning reduces financial stress | Server outages or downtime risks, loss of mining time. |

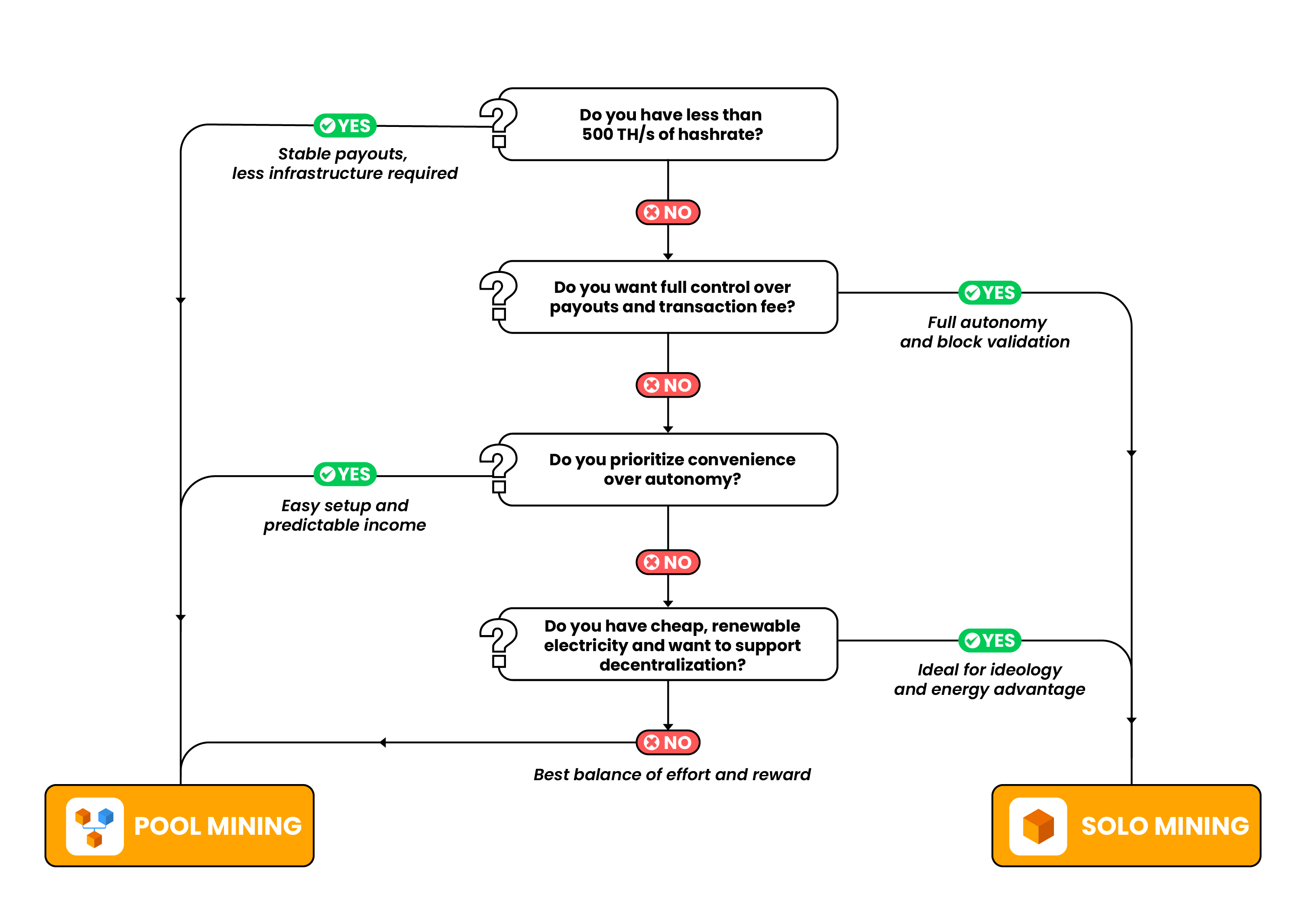

Here’s a simple decision tree to understand which option suits better:

Note: Though this decision tree covers only the basics, you may have several other considerations while choosing which option to go for, depending on things like:

- - Risk tolerance

- - Being an experienced miner or a novice

- - Availability of time and/or resources to manage full nodes

- - Having enough technical understanding on the subject

So, ultimately, choosing to use a pool or mine solo, depends on the your overall objectives and goals.

Top Bitcoin Mining Pools in 2025

Let’s get to the leading pools in the Bitcoin mining industry. Based on current real-time data, here are some of the top mining pools in 2025:

- Foundry USA

- AntPool

- ViaBTC

- F2Pool

- SpiderPool

They’re popular options owing to various factors like high reliability and uptime, transparent fee structures, global server coverage, institutional trust and public-facing reporting, and sometimes even flexible payout options.

How to Choose the Right Mining Pool

With several active Bitcoin mining pools, selecting the right one for anyone can feel overwhelming. But what actually matters? Here's a breakdown of the key considerations:

-

Key Criteria to Evaluate:

- Payout Method: Do you want stable earnings (PPS) or prefer maximizing potential rewards (PPLNS)?

- Pool Fees: Ranges from 0% to 8%. Lower isn’t always better and reliability matters.

- Minimum Payout: If you’re a small miner, a high minimum (e.g., 0.01 BTC) might mean you wait weeks to get paid.

- Server Locations: The closer the pool servers are to you, the lower your latency and the more effective your mining. -

Additional Factors:

- Dashboard UX: Are stats, earnings, and alerts easy to read and access?

- Auto Withdrawals: Useful for noncustodial storage and auto-conversion.

- Multi-coin Support: Some pools also support mining other cryptocurrencies. -

Red Flags to Watch Out For:

- No team transparency or contact info

- Inconsistent or delayed payments

- Promises of ‘guaranteed profits’

- No published hash power or block statistics

Remember: a solid mining pool doesn't just share rewards, but also shares accountability. Prioritize pools with uptime reports, community support, and a clean track record.

Why Mining Pools Power Bitcoin

Bitcoin mining had started as a solo effort. But in today’s landscape of industrial-scale infrastructure and razor-thin margins, mining pools are the connective bridge to the ecosystem. They don’t just aggregate hash power, but also distribute risk, streamline rewards, and make the network accessible to anyone with a rig. We’ve covered how mining pools work, how payouts are calculated, and why choosing the right one isn’t just about fees. It’s about transparency, tech, and trust.

So, is pool mining still the best way to mine Bitcoin?

For most miners — absolutely. Whether you're running a single S19 or managing a mid-sized farm, mining pools help you stay competitive in the game, smooth out your rewards, and focus on optimizing performance. But the decentralization trade-offs are important to be considered. And as Bitcoin matures, the conversation about who controls the hash power becomes more important than ever.

One thing’s clear: in the race for the next block, it pays to go together.