What is Bitcoin Mining and How It Works: An Overview

What is Bitcoin Mining?

At its core, Bitcoin mining is the process of verifying and adding transactions to the Bitcoin blockchain. Miners compete to solve complex mathematical problems using powerful computers. The first one to solve the puzzle gets to add a new block to the blockchain. And, as a reward, they earn freshly minted Bitcoin plus any transaction fees within that block.

This process isn't just for show. It keeps the Bitcoin network secure and decentralized. Think of it like a giant digital audit system where every participant is checking each other's math. Since there is no central authority, there is a consensus mechanism in place between the participants. As stated in the Bitcoin whitepaper this happens through a system called Proof-of-Work (PoW).

How Bitcoin Mining Works ?

Technically, miners are trying to find a ‘hash,’ which is a string of characters that’s below a target value set by the network. This is the core of Bitcoin’s Proof-of-Work (POW) system - a digital competition of brute-force calculations. The hash must begin with a certain number of zeros, which makes finding it a massive game of trial and error. Your machine guesses billions of times per second— literally. The amount of computational power it takes a machine to perform these hash checks is called as hash rate or hash power.

When a valid hash is found, a new block is created, which includes a batch of pending Bitcoin transactions. This block is then broadcast to the network for validation. Once accepted, it becomes part of the permanent blockchain, and the winning miner receives a block reward, which is currently 3.125 BTC as of the April 2024 halving. The winning miner also receives the transaction fees from the transactions inside the block.

In short, miners are the backbone of Bitcoin. Without them, the system wouldn’t function.

BTC Mining: Then and Now.

In Bitcoin’s early days, around 2009 to 2012, you could mine BTC with a regular laptop CPU. But as more people joined in, the mining difficulty increased.

Then came GPUs (graphics cards), which could process hashes faster than CPUs. By 2013, Application-Specific Integrated Circuits (ASICs) took over. These were machines built solely to mine Bitcoin. A popular early model in 2013, the Antminer S1, could deliver 180 GH/s (gigahashes per second). For comparison, the latest models like Bitmain’s Antminer S21 Hyd in 2025 can exceed 300 TH/s (terahashes per second).

With ASICs dominating, solo miners at home began to fade out, replaced by industrial-scale operations. These are massive facilities, often in rural regions with cheap electricity, housing thousands of machines stacked. Companies like Riot Platforms and Marathon Digital Holdings run such mining farms and contribute a significant chunk to the global Bitcoin hashrate.

Mining Hardware Explained

Like in motorsports, the performance of a car matters, so does the hardware in Bitcoin mining. And no, you can’t just download a Bitcoin mining app on your phone and call it a day!

In short:

- CPU = multitasker (but slow)

- GPU = faster multitasker

- ASIC = focused on a single task at max speed and efficiency

- ASIC = focused on a single task at max speed and efficiency

Most well-known ASIC mining manufacturers in 2025 include Antminer, Bitdeer, Canaan, and Microbt. But mining isn’t just about owning the hardware. There are several other factors to consider.

Solo Mining vs Pool Mining

Mining alone is like entering a lottery where you buy one ticket, and someone else buys 10 million. Technically, you could win. Realistically? You’ll just burn a lot of electricity and get no Bitcoin.

Pros and Cons of Solo Mining

| PROS | CONS |

|---|---|

| You keep the entire block reward (currently 3.125 BTC + transaction fees) | Extremely rare to find a block |

| More privacy and control | Irregular payouts (if any) |

| Useful for large-scale operators with tons of hash power | Not feasible for most individuals |

To make rewards more consistent, mining pools emerged as a way for miners to team up and share earnings. Instead of waiting for a lucky block, members of a pool combine their hash power and share the rewards based on their contribution.

This way, even if you only bring 0.01% of the power, you get 0.01% of every block the pool finds. It is a steadier and less frustrating way of mining BTC.

Major Mining Pools in 2025

| MINING POOL | DESCRIPTION |

|---|---|

| Foundry USA | Largest Bitcoin pool in 2025, catering to institutional miners. |

| Antpool | Holds a significant global market share. |

| Via.BTC | One of the earliest and has a strong presence in Central Asia. |

| F2Pool | Established in 2013, one of the longest-running pools. |

| SpiderPool | Global Bitcoin pool with a presence in multiple regions. |

Together, these pools account for over 75% of the mining pools’ total market share as of early 2025 .

Understanding Mining Pools

A mining pool is like a co-op for Bitcoin miners. Everyone contributes processing power to a collective effort to find blocks, and then shares the profits.

- PPS (Pay Per Share): You get paid for every valid share submitted.

- PPLNS (Pay Per Last N Shares): Rewards are based on your contribution to the last set of shares that found a block.

- FPPS (Full Pay Per Share): Like PPS, but includes transaction fees in the mined block too.

Each model affects how stable or risky your income is. PPLNS, for instance, can result in higher earnings long-term, but more variance in daily payouts.

Bitcoin Block Reward and Halving Events

Bitcoin's supply is set in stone (technically in code). One of its most iconic features is the halving event.

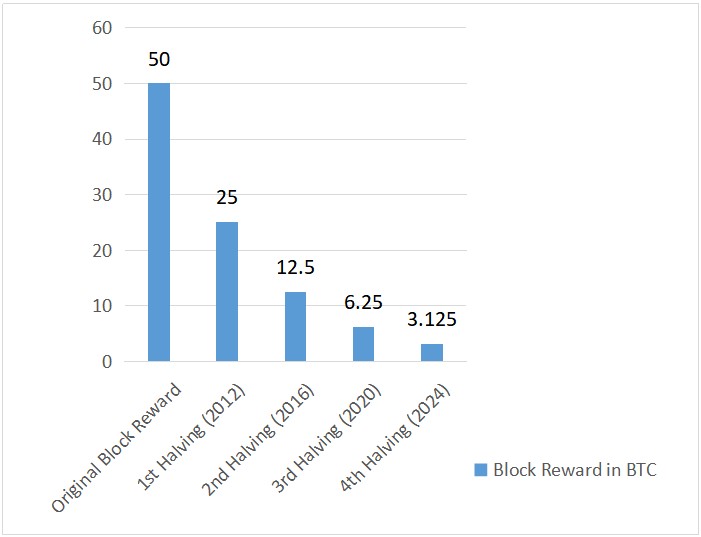

As per the protocol, after every 210,000 blocks, roughly every 4 years, the block reward is dropped by half. As of April 2024, the block reward has dropped to 3.125 BTC from the previous 6.25 BTC. This incentivizes scarcity, and maintains Bitcoin’s status as a deflationary currency.

Here’s what has happened historically:

After each halving, miners earn half as much BTC per block, making it harder to stay profitable, especially for smaller or less efficient operations. Prices historically surged post-halving due to perceived scarcity, but volatility also followed.

So, post-halving, only the most efficient setups tend to survive. Mining farms start retiring outdated ASICs and seek cheaper sources of electricity. Some miners hedge with altcoins or merge mining strategies, while others double down on next-gen hardware.

Bitcoin Difficulty Adjustment

Let’s say suddenly thousands of new miners join the network. Blocks

would start being found too fast. That’s where Bitcoin’s self-adjusting mechanism kicks in. It’s like cruise control for the

blockchain.

Mining Difficulty is a measure of how hard it is to find a new block. It

adjusts roughly every 2,016 blocks (around two weeks), depending

on how fast blocks were found in the previous cycle.

Mining Difficulty = Target Time (2 weeks) / Actual Time to Mine Last 2016 Blocks

If it was too quick, difficulty increases. If it was slow, it decreases. Without difficulty adjustment, mining could spiral into chaos. Blocks would either be mined too quickly - flooding the chain, or too slowly - clogging transactions. Difficulty ensures the average block time remains around 10 minutes, preserving Bitcoin’s predictability and trust.

Where Do Mining Rewards Go?

Alright, so let’s say you’ve won a Bitcoin block reward. But where

does it go?

Into your wallet, of course. But here’s where things can get a bit

tricky, as there are various options to choose from, and some of them.

| Type | Description | Examples | Pros | Cons |

|---|---|---|---|---|

| Cold Wallet | Offline and air-gapped versions, used for secure, long-term storage. | Hardware wallets (Ledger, Trezor), Paper wallets | Extremely secure from online attacks | Inconvenient for quick transactions, risk of physical loss |

| Custodial Wallet | Wallets where a third party holds your private keys. | Binance, OKX, Coinbase. | Easy setup, password recovery, often insured, easy conversion to fiat or altcoins. | Trust-based, user doesn’t control private keys, high security risk if left not transferred for long periods. |

| None-custodial Wallet | Full control User retains over private keys and wallet access. | Trust Wallet, MetaMask, Mining Race | Full ownership, enhanced privacy and security | Irrecoverable if seed phrase is lost, requires more responsibility |

Biggest Bitcoin Miners Today

When it started, mining Bitcoin was a solo sport. Fast forward to 2025, and it’s more Formula 1 than go-karting. Although solo miners and mining pools still exist, the Bitcoin mining scene today is dominated by corporations. In the first quarter of 2025, these corporations mined around $800 million worth of Bitcoin . The biggest among these are:

- Marathon Digital Holdings

One of the largest North American miners, running operations that contribute over 4% of global hash rate.

- Riot Platforms

Known for their Texas-based mining facilities powered by renewable sources and smart-grid energy solutions.

- Bitdeer Technologies

major player with ties to Bitmain and data centers spanning the U.S., Norway, and Asia.

These giants operate mining farms with tens of thousands of ASICs and benefit from institutional financing, long-term power contracts, and even government incentives in certain jurisdictions.

Private Farms and Cooperative Pools

Mid-sized players still thrive, often pooling resources with co-located miners. These operations might run hundreds or a few thousand ASICs in warehouse-style settings. Some rent out hash power via cloud services or hosting plans for small-scale investors who want exposure without handling hardware.

Individuals: Are They Still Mining?

Surprisingly, yes, especially in regions with surplus hydro-power or off-grid setups using solar or geothermal energy. However, ROI expectations must be realistic. Most hobbyists mine for ideology, fun, or education rather than profit.

Bitcoin Mining Around the World

According to the latest Bitbo data:

1. United States: Still leads with over 38% of global hash power,

thanks to deregulated electricity markets and investor backing.

2. China: Despite an official ban, mining persists in stealth via VPNs

and off-grid setups, especially in rural regions.

3. Kazakhstan: Popular for hosting due to low power costs—

though plagued by infrastructure and regulatory turbulence.

4. Canada: Despite a slight drop in hashrate, Canada continues to

be one of the top players in BTC mining powered in part by

hydroelectricity and locally sourced natural gas.

Geopolitical and Regulatory Impacts

Mining is increasingly influenced by politics. The EU is pushing green-energy standards. The U.S. is debating the impact of the mining grid. In contrast, places like El Salvador and Bhutan are leaning in, using volcanoes and hydro dams to power national mining ambitions.

Green Mining Initiatives and Renewable Energy

With ESG (Environmental, Social, and Governance) pressure

mounting, miners are going green:

- Texas miners tap into demand-response grids.

- Iceland, Canada, and Norway utilize hydro and geothermal power.

- Oman, UAE, and Saudi Arabia are exploring renewable sources of

energy and wasted energy that can be redirected to mining.

- Companies like Genesis Digital Assets and Bitfarms boast 100%

renewable power use.

The narrative is shifting: from energy wastage to sustainable

infrastructure partner.

Costs Involved in Mining

Mining isn’t just plug-and-play. There are serious costs, and they’re not all paid in Bitcoin. ASICs can cost anywhere from $2,000 to $8,000 depending on brand, performance, and market demand. And the lifespan? About 3–5 years before becoming unprofitable due to difficulty increases and power draw.

Apart from the miners themselves, electricity is the single biggest

operational cost. Here’s a rough breakdown:

- Cost-effective regions: < $0.05/kWh

- Borderline profitable: $0.06–$0.08/kWh

- Unprofitable: > $0.10/kWh (unless using super-efficient gear)

Cooling systems (fans, HVAC, or immersion cooling) also rack up expenses, especially in hot climates. And don’t forget space rental, insurance, and maintenance.

But online profitability calculators like NiceHash, WhatToMine, CryptoCompare let miners plug in their hash rate, power consumption, electricity cost, and see estimated returns. For example, if you have an Antminer S21 (~250 TH/s, 17.5 J/TH) running at $0.04/kWh, you might earn $4 to $6/day, before pool fees and downtime.

Difficulty and Profit Margin Fluctuations

Difficulty spikes when more miners enter the network. That means more competition and fewer slices of the Bitcoin pie. Combine that with fluctuating BTC prices, and you’ve got a volatile business model.

One week, you’re making $15/day per machine; the next, it’s down to $2, or a loss if BTC dips and electricity stays the same. What you can do is monitor profitability weekly. Some miners even switch off gear temporarily when returns drop below breakeven.